Weekly Roundup July 11th

Markets were quiet on Monday 4th, as Independence day in the USA took its toll on trading activity. However, action in the precious metals markets really kicked off on Tuesday, as Portugal’s debt was downgraded and investors once more looked toward safer haven investments. Action in gold bubbled over to the silver market, and the commodity bounced off its short term resistance level of around $33.60 to 33.90.

With China raising interest rates on Wednesday 6th, the market was set for another downward move, however to counterbalance this view, weakening concerns over Portugal debt and the higher cost of money to the Euro zone raised some investment concerns and precious metals once more benefited. Still the US debt ceiling is not finalised.

The 7th started in similar fashion to the previous day and, with the European Central Bank now raising rates, silver looked set to be out of fashion once more. However, with US jobless claims coming in better than expected and a resurgence of the US dollar against the Euro, investment returns to the stock market. Now silver begins to benefit from the firmer looking US economy.

The week ended in poor fashion, with US employment numbers coming in far weaker than expected and pointing toward a very sluggish economy. With silver a commodity used broadly in industry the commodity began to reverse its fortunes, but this reversal didn’t stand long as the price clung on to the tailcoat of gold and ended with another daily positive movement.

Silver ends the week up 8.4% on the previous week’s close.

The Week Ahead

With recent support levels holding, it seems that the returning bullish sentiment for silver will continue through the summer. Look for more gains, any break out above $40 being a strong indicator of a major upside movement, and buy on short term weakness.

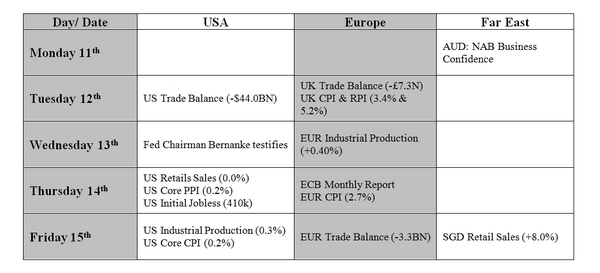

Major Economic Data Releases and Forecasts for the week ahead:

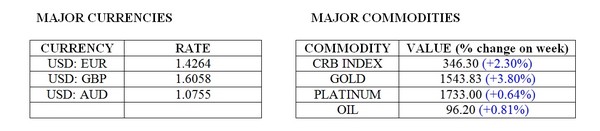

Week In Review – Currencies and Commodities

Week In Review – International Exchanges

Did You Know

The value of the FTSE 100 Index on 1st July 2011 was 5642.50. Since then, it has shown a capital increase of 6.16%.

The value of silver on 1st July 2001 was $4.27. Since then, it has shown a capital increase of an astonishing 758.92%.