Week In Review 24 July 2011

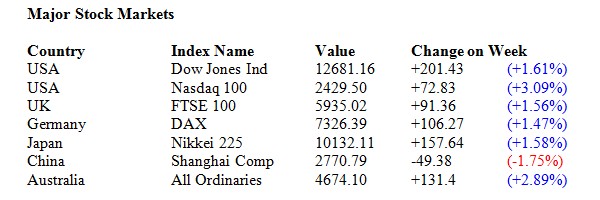

Stock Markets around the world proved mildly volatile, reacting to debt news from Europe and the USA.

The beginning of the week saw further falls, as Europe’s woes continued with a debt rescue package for Greece seemingly some way off. However, by Tuesday European leaders had started to talk bullishly about their hopes for a far reaching package to be in force by the end of the week, and markets started to react positively.

With little other economic news out during the week, markets stabilised through Wednesday and Thursday and then sought to make gains upon confirmation that the package for Greece had been agreed.

Starting positively on Friday morning, in reaction to the debt refinancing news and also better than expected numbers from JP Morgan overnight in the States, all looked on a firmer footing than it has for weeks.

As the news was digested, markets fell back a little from the day’s highs. Analysts noted that the UK has not participated in the €96billion Euro bailout, that the amount of Greek debt needing immediate solving is, in fact, of the order of €150 billion, and now sights are set on the other countries at risk – mainly Italy, Spain, Portugal, and Ireland. Wall Street, too, failed to remain in positive territory on Friday.

Sarkozy, France’s President, is talking about the European Emergency Fund becoming the equivalent of a European IMF.

Though stock markets regained the ground lost the previous week, there is still plenty of nervousness around. Eyes over the coming months will be firmly on debt across Europe and the USA.

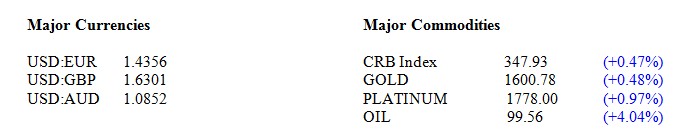

Silver and gold reacted well during the week. Though turning south briefly, both metals regained their poise toward the end of the week. Indeed, Silver has broken through the $40 level, and closed the week above it.

Silver ends the week up 2.0% on the previous week’s close.

Last Week’s Investment Markets At A Glance (Closing Values Friday 8th July)

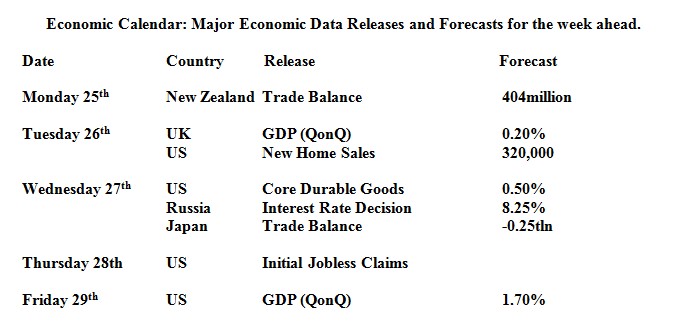

The Week Ahead

Though debt worries will continue to dominate the thoughts of traders and investors alike, and as the reporting season gathers pace in the US, markets could react to US durable goods orders numbers due out on Wednesday, and then initial jobless claims on Thursday. Together with the GDP figure for the US released on Friday, these numbers could give a clearer indication of the strength of the recovery in the USA.

As for silver, we have now had three weeks of gains, seeing the price move from around $33.50 to over $40. It would be good at this level to see some consolidation and the building of a new solid line of support at around current levels. With investors’ still stock market cautious, it is possible that we could see further gains over the coming weeks and months. Any weakness in the price should be seen as a buying opportunity.

BuySilver.org’s Weekly Silver Roundup On Youtube

For all the happenings in the world of gold and silver over the past week, make sure to check out our analysis by our resident financial expert Michael Barton.